A recent report highlights a significant surge in NBA franchise valuations, a trend that could prompt the ownership group of the Oklahoma City Thunder to consider selling the team. As the league’s financial landscape continues to expand, increased franchise worth is creating new opportunities-and pressures-for owners weighing their long-term investment strategies. This development comes amid broader market dynamics reshaping sports business, potentially signaling a major shift for one of the NBA’s most closely watched franchises.

Thunder Ownership Faces Pressure Amid Surging NBA Franchise Valuations

Ownership of the Oklahoma City Thunder is reportedly under increasing scrutiny as surging franchise valuations across the NBA create a surge of interest in potential sales. Experts in the sports business industry suggest that the current ownership group could be weighing their options more seriously, especially with the league’s soaring revenue and expanding global fanbase making the timing ripe for a lucrative exit. Industry insiders point to a mix of economic factors and shifting market dynamics as key drivers behind the mounting pressure.

Several factors contribute to this heightened speculation among potential buyers and stakeholders:

- Record-breaking TV deals that have increased franchise projection values.

- Growth in digital and international markets,

- Rising real estate value tied to arena locations and commercial developments.

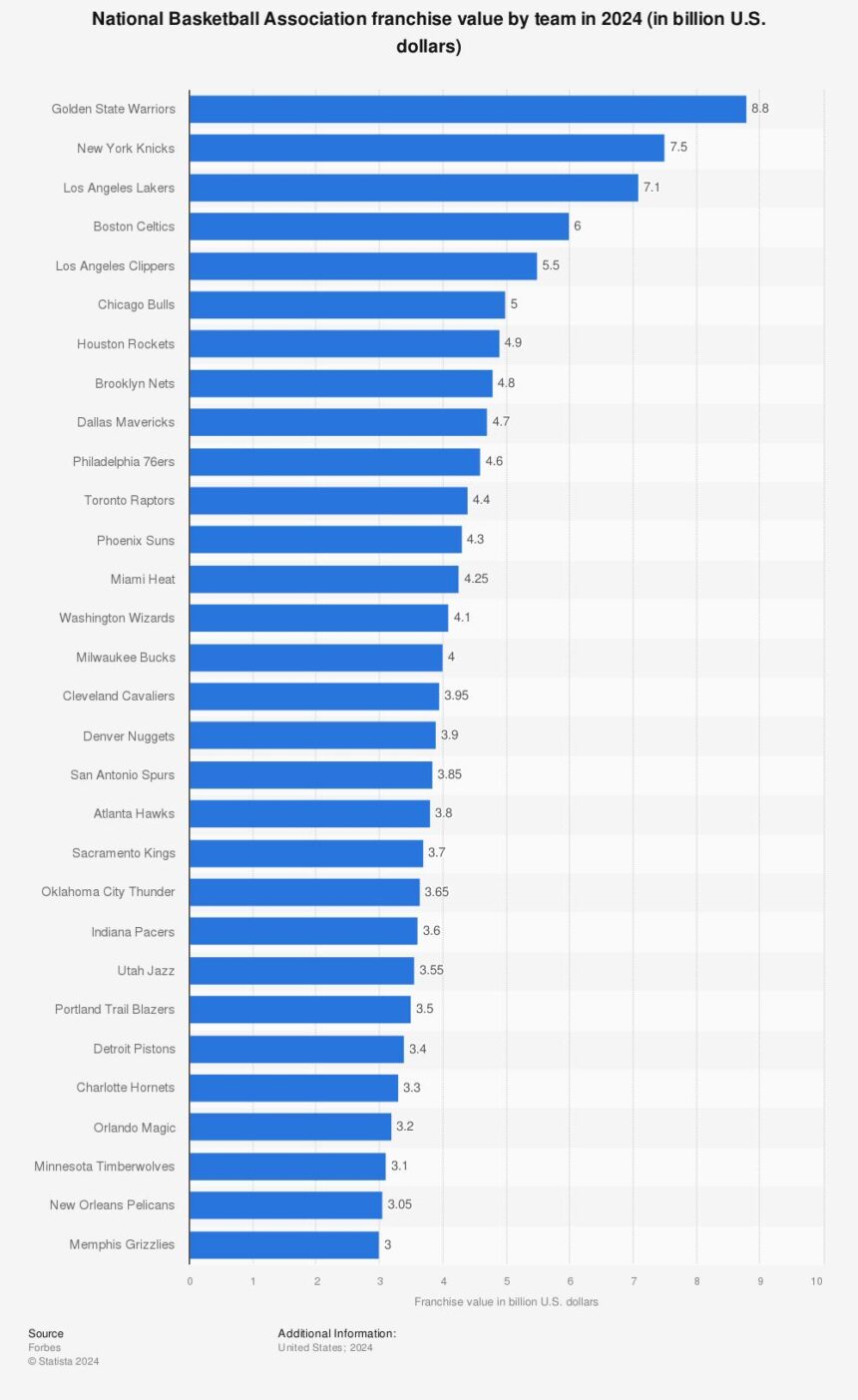

A recent breakdown of NBA franchise valuations highlights the rapid appreciation in team worth, with the Thunder’s valuation trailing only a few franchises yet positioned for significant growth if the market continues along this trajectory:

| Franchise | 2020 Valuation (Billion $) | 2024 Estimated Valuation (Billion $) |

|---|---|---|

| Los Angeles Lakers | 4.6 | 6.2 |

| Golden State Warriors | 4.3 | 6.0 |

| Oklahoma City Thunder | 2.0 | 3.1 |

| Denver Nuggets | 1.2 | 2.1 |

Market Trends Suggest Optimal Timing for Potential Sale of Oklahoma City Franchise

NBA franchise valuations continue to soar, driven by increased media rights deals, expanding global fan bases, and lucrative sponsorship agreements. This upward trajectory has positioned the Oklahoma City Thunder as a prime candidate for potential ownership restructuring. Experts note that current market conditions offer a rare window of opportunity for the Thunder’s owners to capitalize on the inflating asset price, particularly given the franchise’s strong youth core and emerging market appeal.

A snapshot of recent franchise sales underscores this trend, highlighting a substantial rise in acquisition prices over the past decade. Industry insiders speculate that factors such as:

- Record-breaking TV contracts secured through 2030

- Increased fan engagement through digital platforms

- Localized economic growth in Oklahoma City

could further inflate the team’s valuation. Below is a concise comparison of select NBA franchise sales that illustrate the market’s upward momentum:

| Franchise | Sale Year | Sale Price (in billions) | Valuation Increase Since Sale |

|---|---|---|---|

| Brooklyn Nets | 2019 | $2.3 | +55% |

| Los Angeles Clippers | 2014 | $2.0 | +80% |

| Denver Nuggets | 2022 | $1.1 | +25% |

Experts Advise Strategic Positioning to Maximize Return in Competitive Sports Market

Industry analysts emphasize the importance of strategic positioning for franchise owners looking to leverage the current surge in NBA team valuations. With market values ascending rapidly, positioning a sports franchise for maximum appeal means balancing short-term revenue opportunities with long-term brand equity. Experts suggest owners must focus on:

- Enhancing fan engagement through digital platforms to increase franchise visibility

- Innovating sponsorship deals tailored to evolving audience demographics

- Optimizing venue experiences that drive higher attendance and ancillary revenue

These factors contribute to crafting a resilient asset that can demand premium valuations in an increasingly competitive marketplace.

Furthermore, a comparative analysis of recent NBA team sales reveals key metrics driving owner decisions. Below is a concise overview of valuation growth relative to annual revenue and market size, serving as a benchmark for franchises like the Thunder contemplating a sale:

| Team | Valuation (Billion $) | Annual Revenue (Million $) | Market Size Rank |

|---|---|---|---|

| Golden State Warriors | 7.3 | 450 | 4 |

| Dallas Mavericks | 3.7 | 260 | 9 |

| Oklahoma City Thunder | 2.8 | 180 | 25 |

| Miami Heat | 3.5 | 280 | 15 |

Such data underline the potential upside for franchises in mid-sized markets when strategic initiatives are well-executed, proving essential for owners weighing the timing of a sale amid this bullish NBA economy.

The Conclusion

As NBA franchise valuations continue to climb unprecedented heights, the Thunder ownership faces growing pressure to capitalize on the booming market. While Oklahoma City’s leadership has yet to comment on potential sale discussions, industry insiders suggest that the current financial climate could make a deal increasingly attractive. With franchise values showing no signs of slowing, the coming months may prove pivotal in shaping the future of the Thunder and the broader landscape of NBA ownership.